As we close the doors on 2025, the short-term rental (STR) industry stands at a historic vantage point. What began years ago as a fragmented collection of “mom-and-pop” hosts has matured into a sophisticated global asset class. To mark the end of this pivotal year, I have compiled this exhaustive research—drawing from the latest data from The Host Report, AirDNA, and our ongoing insights at SCALE—to provide a definitive look at how 2025 reshaped our market forever.

The “Gold Rush” is officially over. In its place, we find The Great Realignment: a professionalized landscape where success is no longer guaranteed by inventory alone, but by data-driven agility and operational excellence.

1. The Performance Paradox: Occupancy Over Price

For much of the post-pandemic era, industry growth was artificially inflated by skyrocketing Average Daily Rates (ADR). In 2025, the bubble stabilized. Our research shows that the market has shifted its weight toward occupancy as the primary driver of revenue.

-

The Global Snapshot: In the United States, occupancy rose to 53.1% (a 3% YoY increase), while ADR growth cooled to a modest 2%.

-

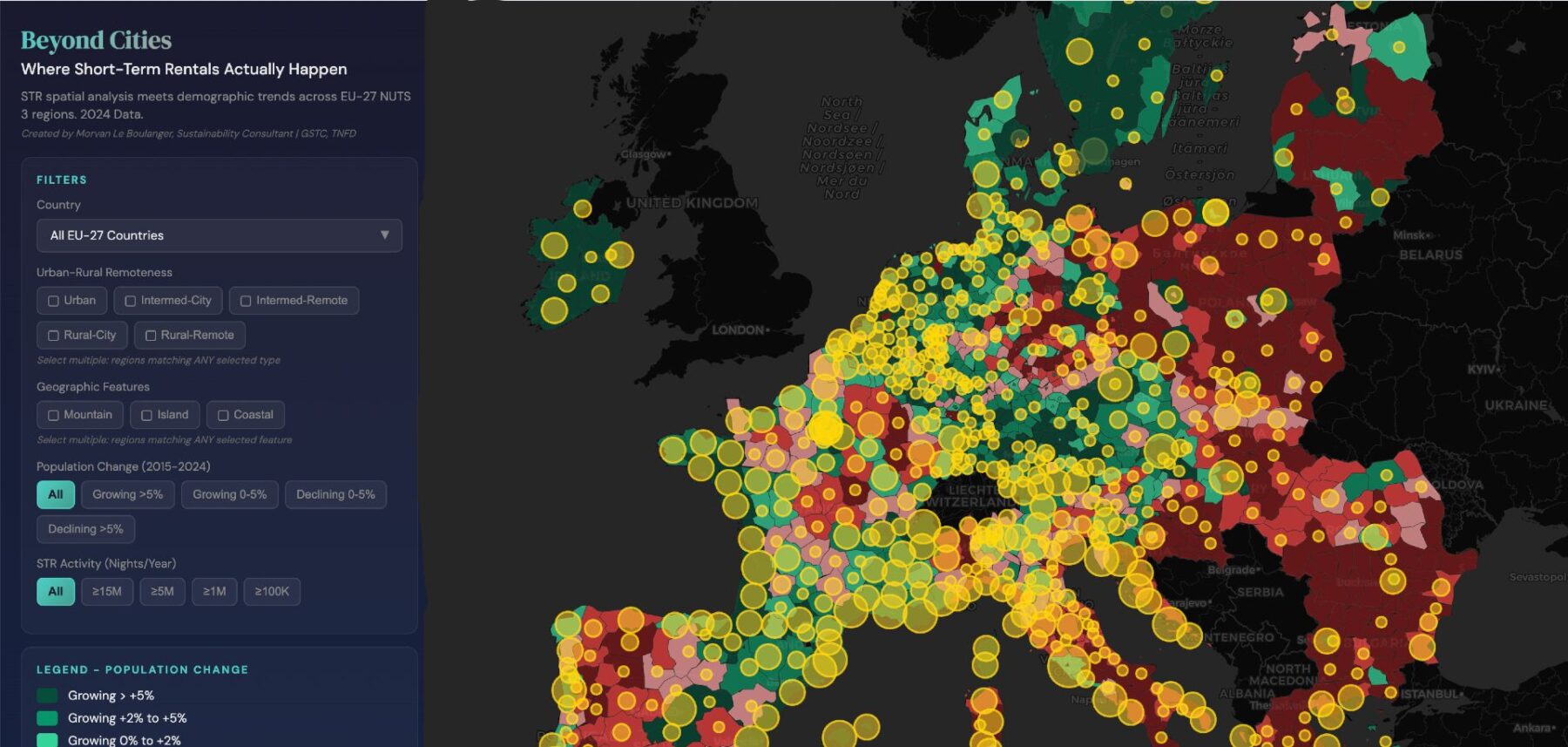

The European Surge: Despite intensifying regulations, Europe saw a massive 9.1% jump in occupancy. Curiously, ADR remained flat (+0.1%), signaling that professional managers prioritized “heads in beds” to maintain cash flow amidst high supply.

-

The Recovery Leaders: We tracked remarkable rebounds in specific regions. Maui (+49%) and Florida (+25%) led the pack, proving that travelers are returning to “classic” destinations, albeit with higher expectations for value.

2. The Death of the “National” Strategy

One of the most profound shifts I’ve observed this year is the widening gap between massive national brands and hyper-local experts. At SCALE, we have always championed the professional operator, and 2025 proved why.

-

Local is King: Operators managing 6 to 20 properties are the fastest-growing and most resilient segment. Their ability to adapt to local culture and regulations has allowed them to outperform rigid, large-scale firms.

-

The “4.7 Threshold”: Quality is now a survival metric. Our data indicates that property managers with ratings below 4.7 stars saw nearly double the churn rate (24%) compared to top-tier performers. In 2025, hospitality is no longer a soft skill—it is a financial imperative.

3. Shifting Guest Behaviors: The “Wait and See” Era

Through our year-end research, we identified a paradoxical trend in how guests book. Lead times are shrinking, yet the length of stay is expanding.

-

Compressed Booking Windows: The “last-minute” culture has solidified. In the U.S., the average booking window dropped to 26.8 days. In France, it’s even tighter at just 19 days. This requires hosts to be far more aggressive with real-time dynamic pricing.

-

The Slow Travel Movement: Once guests arrive, they stay longer. Average stays rose to 5.7 nights in the U.S. and 6.6 in Europe. The “work-from-anywhere” legacy continues to support longer, mid-week bookings that were previously rare.

4. Regulation: From Chaos to Standardization

As we look back at 2025, regulation has moved from being a localized threat to a global operational standard.

-

European Enforcement: High-profile cases, such as Spain’s $75 million fine against platforms for unlicensed listings, signaled the end of the “grey market.”

-

A New Clarity: While stricter, these regulations are bringing a level of standardization that helps professionalize the industry. At SCALE, we see this as an opportunity for serious operators to distance themselves from amateur competition.

5. AI as the Strategic Co-Pilot

If 2024 was about the hype of AI, 2025 was about its utility. We have moved beyond simple chatbots into the era of Predictive Hospitality.

-

Beyond Historical Data: The most successful managers this year stopped looking at what happened last year and started looking at real-time search intent.

-

The Human-AI Balance: AI is now the “co-pilot,” handling the heavy lifting of revenue management and guest communication, which allows the host to return to what matters most: the human connection.

Closing Thoughts: Looking Toward 2026

As I conclude this research for the end of 2025, the data points to a bifurcated future. In markets like the U.S. and Australia, demand is almost entirely domestic (94%+). Meanwhile, Europe remains the world’s playground, with a massive reliance on international travelers.

To my colleagues in the industry: 2025 was the year we grew up. The path forward requires us to be more than just “hosts”—we must be data scientists, local ambassadors, and tech-savvy entrepreneurs.

The Great Realignment is complete. Now, the real work begins.