SCALE 2026 Trends Report: The year the industry rewires itself

Posted on - December 15th 2025

2025 hasn’t been the year of dramatic collapses or wild booms that we expected (Sonder aside). Instead it became the moment the industry reorganised itself, building the resilience it needed to face what’s coming next.

Regulation tightened. AI moved from “fun gadget” to “how did we ever run a business without this”? Competition shifted into unexpected corners and travellers became more intentional, more value-driven and much harder to impress.

The ground hasn’t disappeared; it’s just moving under our feet.

So the real question for 2026 is: Who’s adapting fast enough? And who’s still using the strategies of yesterday?

Many of the themes in this report didn’t just emerge from market data. We saw them unfold live on stage throughout SCALE’s 2025 events. SCALE has become a kind of barometer for what’s next in short-term rentals, and the conversations this year made one thing clear: the industry is already shifting beneath our feet.

Regulation & Risk: The New Operating Reality

2025 has become the year regulation stopped being a “future threat” and settled into everyday operating reality. Across the world, governments have moved out of observation mode and into implementation.

In some places this has already translated into hard caps, formal licensing and active enforcement. In others, it’s still wrapped in consultation papers, task forces and public debate.

But the global regulatory narrative is now unmistakable: short-term rentals are no longer seen as a side-stream of tourism, but as part of the housing ecosystem itself.

And for many operators, this has shifted from a background concern to a central factor shaping future strategy.

Compliance now touches pricing, inventory strategy, distribution, owner relationships and even market expansion decisions. The era of casually listing and seeing what happens is behind us. The industry has crossed into a phase where structure is not optional, it’s the cost of participation.

The Rise of Patchwork Segmentation

What’s particularly interesting is that this shift isn’t happening in a uniform way. There is no single “global STR rulebook.” Instead, regulation is emerging as a patchwork, shaped by housing pressure, tourism dependency, political mood and lobbying power.

And it’s within this patchwork that a new concept is quietly solidifying: segmentation.

Rather than treating all short-term rentals as one blunt category, authorities are increasingly recognising that the market is made up of very different types of supply, each with its own impact.

What’s emerging is not a single global model, but a shared logic appearing in varying forms:

- primary-home hosts

- small multi-unit operators

- large professional portfolios

- aparthotels and serviced accommodation

- rural and heritage stays

The rules applied to each may vary widely by country or city, but the principle is starting to repeat: not all STRs are the same, and they are no longer regulated as if they are.

This “patchwork segmentation” is shaping the next phase of the industry, creating opportunities for professionally run operations to expand with clarity. Good news for structured operators, but added pressure for casual hosts who hoped the rules would stay blurry and undefined.

CEO of Pricelabs, Richie Khandelwal says, “The short-term rental industry has long been a tale of two halves, one made up of casual hosts and the other, management companies with varying levels of operational maturity. However, now both of those groups are learning that the key to long-term success isn’t luck or timing, it’s professionalism.”

Alexander Lyakhotskiy, CEO of Pass the Keys, echoes this shift: “Regulatory uncertainty, rising costs and changing traveller behaviour have made 2025 a year of hesitation. But 2026 won’t reward operators sitting still. Professionalisation means stepping out of firefighting mode, investing intentionally in systems and teams, and giving yourself space to plan strategically rather than reactively.”

What matters in 2026 is not whether regulation exists, because it does. It’s how intelligently operators adapt to a world where the rules are layered, local and constantly evolving.

Steve Schwab, CEO of Casago comments: “We are not heading into a “crackdown,” we are heading into a professional era. The days of bad actors skating by on lax rules are ending, and what replaces them is a clearer contract with communities: standards, accountability, and real local contribution. Operators who embrace regulation, invest in compliance, and show they are good stewards of the community will not just survive; they will own the most durable, defensible inventory in their markets.”

Automated enforcement is no longer theoretical

Alongside this regulatory shift, enforcement itself is quietly being re-engineered. City teams are now using the same AI-driven tools as OTAs and PMS platforms to monitor listings in real time. If a property sits outside the rules; whether through licensing, zoning or usage, the bureaucratic system often knows before the operator does.

Compliance has stopped being an annual checklist item and become a weekly operational discipline. For professional operators, this increases pressure. For unstructured supply, it increases risk.

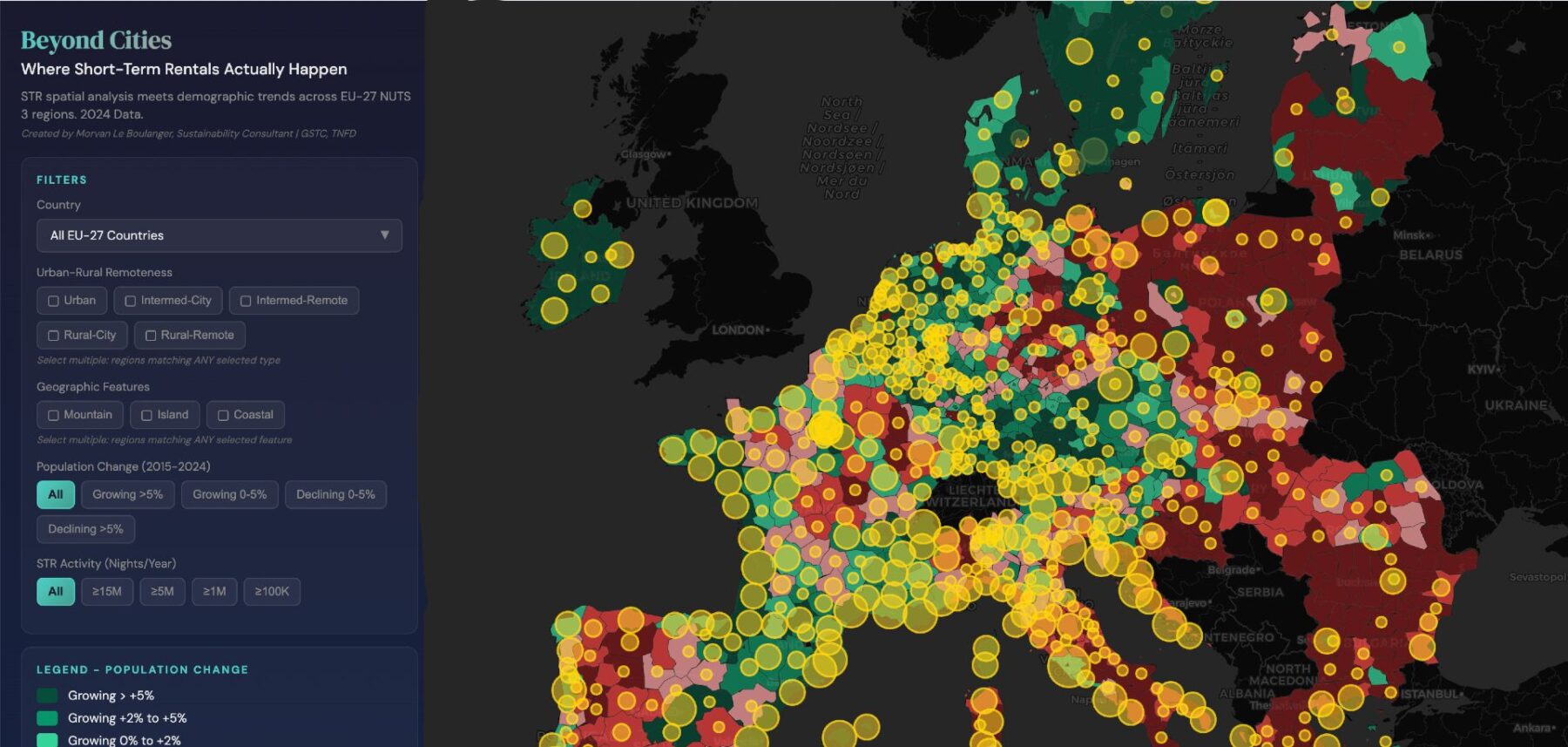

Displaced demand is already reshaping the market

As restrictions tighten in urban centres, supply is being squeezed and demand is doing what demand always does when space becomes scarce. It’s moving.

Across markets globally, we’re seeing guests spill outward into:

- Secondary cities

- Regional hubs

- Peripheral rural destinations

What’s interesting is that this displacement isn’t always seen as a compromise by travellers. Many guests are actively choosing more space, more calm and more character once they leave the denser city cores behind.

For operators positioned outside major urban centres, this shift represents one of the most under-appreciated growth opportunities of the next cycle.

Robin Clifford from Guesty discussed this in our interview at SCALE UK

Competition 3.0: New Players, New Tensions

Competition in short-term rentals no longer comes from where most operators expect to find it. You’re not just competing against local property managers or the investor who just bought out a rival portfolio.

In 2026, competition is layered, indirect and often built into the very systems operators rely on to run their businesses.

The industry has entered what can best be described as Competition 3.0, an era where power is shifting between operators, platforms and technology providers in more subtle, structural ways.

At the heart of this shift sits a growing tension that many operators feel but few are keen to openly articulate.

PMS vs PMC: The quiet tug-of-war everyone feels

I sat in on a revealing session at SCALE UK in November. Louis Andrews of OVO Network spoke candidly about losing a long-standing owner client; one they had consistently delivered strong booking performance for, year after year. They didn’t lose that owner to a competitor down the road.

They lost them to their PMS.

On the surface, the pitch is seductive: cut out the management fee, keep more of the margin, let the tech do the work. PMS platforms are increasingly courting owners directly with the promise of simplicity and savings. Positioning themselves not just as tools, but as operational solutions.

And this is where the tension sharpens.

What many owners don’t see is everything that sits outside the PMS environment. The revenue management decisions. The channel mix strategy. The relationship with OTAs. The direct booking ecosystem. The marketing spend. The brand positioning. The guest experience design. The human judgement layered over every automated decision.

A PMS can distribute and systemise and it can optimise within a defined framework. But it doesn’t build demand on its own.

So property managers are now asking the question, not so quietly anymore:

Is my PMS still my operational partner… or is it slowly building a pathway to my owners?

This quiet tug-of-war will shape 2026 more than many in the industry yet realise. And it lands on a far more uncomfortable, unresolved question:

Can a piece of technology ever truly replace the full commercial, strategic and relational role of a professional manager? Or are we still underestimating just how much invisible work happens beyond the software?

The Operator-as-Tech Shift Is No Longer Reserved for the Few

Property managers building their own tech is not new. What’s new is how many more operators can now afford to do it.

Until recently, developing meaningful internal systems required in-house developers, heavy custom builds, and long, expensive roadmaps. AI has flattened that barrier. Automation, data orchestration, workflow logic and even interface design are now dramatically cheaper, faster and simpler to deploy.

At the same time, as PMS platforms edge closer to the owner, ambitious operators are feeling a renewed urgency to reclaim control over their commercial engine. The result is not just better internal tooling — it’s a quiet but growing shift in identity.

We are increasingly seeing operators who don’t simply run tech… they become technology companies in their own right. Some are licensing internal systems. Some are productising their operational IP; and in a few cases, founders are even stepping away from management entirely to pursue the technology opportunity full-time.

This is no longer about optimisation. It’s about structural independence.

OTAs Are Tightening the Feedback Loop Between Behaviour and Visibility

While PMS and operator dynamics shift behind the scenes, OTAs are refining how influence works at scale.

Airbnb continues to centre its ecosystem around guest loyalty and frictionless booking behaviour. Booking.com is doubling down on loyalty programmes and performance-driven visibility and Expedia is investing further into longer stays and serviced accommodation.

None of this is new, but what is new is the tightening of the feedback loop between operator behaviour and marketplace visibility.

Ranking is increasingly influenced by:

- Pricing responsiveness

- Cancellation flexibility

- Review velocity

- Tool adoption

- and behavioural signals tied to conversion performance

For operators, this doesn’t feel like direct competition, it feels like a gradual narrowing of acceptable operating range. You can still choose how you run your business, but platforms are becoming clearer about which behaviours they reward with demand.

The pushback is real. But so is the professionalism of today’s operators.

For many, OTAs are no longer the centre of gravity; they’re just one component within a wider, deliberately engineered distribution strategy.

In 2026, the tension won’t be about control versus dependency. It will be about how intelligently operators balance visibility, margin, brand and autonomy across every channel they touch.

Platform scale isn’t going away. But neither is operator ambition.

Fragmentation is accelerating at the bottom of the market

While the top end of the industry professionalises, the lower end is moving in the opposite direction.

Investor-led portfolios, algorithm-chasing hosts and self-managed listings with no operational backbone continue to flood the markets. The result is a widening quality gap.

At one end, we have highly structured, brand-led and service-focused operators. At the other, listings where guests quietly wonder how they’re paying premium rates for minimal delivery.

That gap is no longer a crack: it’s a canyon. And for travellers, this creates wildly inconsistent experiences under the same “short-term rental” label.

For professional operators, fragmentation is both an opportunity and a risk. It’s an opportunity to stand apart through trust, consistency and service. But the risk is in the poor experiences elsewhere, which can quietly erode confidence in the category as a whole.

Fragmentation is reshaping competitive dynamics from the bottom up and it’s one of the forces pushing the industry towards a more intentional definition of what “professional management” really looks like.

The real competitive shift of 2026

The most important competitive shift isn’t about who has the most units, the flashiest tech stack or the biggest marketing budget.

It’s about who controls:

their data,

their distribution,

their brand,

and their owner relationships.

In 2026, competition moves away from scale for scale’s sake and towards true strategic independence. The strongest operators won’t necessarily be the biggest, they’ll be the ones least exposed to anyone else’s rule changes.

AI Matures: From Novelty to Infrastructure

If 2023-24 was the year the industry flirted with AI, and 2025 was the year it experimented, then 2026 is the year AI quietly becomes part of the furniture.

Over the last 24 months, AI has quietly slipped into workflows, and – almost without announcement – has become operationally unavoidable.

Enter 2026 and AI will no longer be a feature; it becomes the infrastructure property managers run on.

And yes, this is exactly why we’re bringing the industry together at SCALE With AI on 9 June in Brighton to explore how this shift is reshaping operations, teams and growth models.

AI eats operational friction (and nobody misses it)

What once required entire teams is now managed through layered automation with human oversight. It’s not about AI replacing hospitality, it’s about removing the drag.

- Guest communication

- Pricing adjustments

- Cleaning schedules

- Maintenance forecasting

- Review analysis

- Fraud detection

- Owner reporting

- Task allocation

The immediate impact? For most operators it isn’t futuristic excitement; it’s operational relief.

In 2026, AI stops being a shiny feature and becomes plumbing,” says Steve Schwab, CEO of Casago. “It will sit underneath booking flows, communication, pricing and maintenance, quietly removing friction and predicting issues before they surface. The winners will use AI to give their teams more time for real hospitality.”

From reactive to predictive operations

Enter into 2026, and AI’s real impact won’t be in what it automates, but in what it allows operators to anticipate.

The shift from reactive to predictive operations is already reshaping how businesses feel to run and this will only increase next year.

Instead of responding after something breaks, slips or underperforms; operators are increasingly using AI to anticipate what’s about to happen next:

- An owner at risk of churning

- A maintenance issue before it disrupts a stay

- Early signs of demand compression

- Guest behaviour that could escalate into a problem

This is where AI helps operations become calmer. Less reactive, less edge-of-the-seat. Teams can plan forward instead of sprinting from fire to fire.

Decision-making moves to copilots

Owning a series of dashboards to support strategic decisions is part and parcel of being a property manager. You’re already fully equipped with revenue management, data and operational task management tools.

Where AI excels over these individual tools, is its ability to become your decision partner, answering questions, such as:

- What should I adjust this week?

- Where am I leaking margin?

- Which owners are drifting?

- Which markets are about to tighten?

In this scenario:

The technology proposes.The human decides. The machine executes.

In 2026, this becomes the operational rhythm.

Florian Montag, VP at Apaleo, calls this the gateway to autonomous hospitality. “Agentic AI will move from experimentation to deployment. We’ll see AI agents acting, learning and collaborating across hotel systems; even negotiating in real time with external travel agents or AI-powered booking tools. This shift returns control of data, pricing and distribution to operators.”

The New Shape of Hospitality Teams

What does this mean for your team? As AI absorbs routine work, teams may shrink or they can be utilised in a much more strategically powerful way.

That means, fewer generalists and more hybrid thinkers who bridge:

- Technology with operation

- Automation and the guest experience

- Data and with strategic judgement

The result isn’t the loss of humanity in hospitality, but a sharper focus on where human contribution matters most.

Shahar Goldboim, CEO of Boom, adds: “AI will stop handling isolated tasks and start managing full operational processes: guest search, booking, communications, scheduling and financial workflows. Unified AI systems will reduce tool stacks, compress manual work and give operators the freedom to focus on strategy and experience.”

The real operational risk of 2026? Homogenisation

As tools become more powerful and more widely adopted, a new danger emerges: everything starts to look the same and if we’re not careful, it becomes the beige-ification of a whole industry.

- Same pricing logic

- Same automated messages

- Same templated review replies

- Same “personalisation” that somehow feels oddly… impersonal

In 2026, the competitive edge won’t be who uses AI: we all will. It will be who manages to retain a human fingerprint inside the automation.

The content whiplash (My personal lens)

Because I can’t write about AI without touching on brand and content! Short-term rental operators, listen up…

In the space of just twelve months, the narrative around AI-generated content has flipped repeatedly. My fellow writer, Neely Khan, and I have done full 360-degree turns on our views more times than I care to admit. From resistance, to fascination, to full ‘protect the humans’ mode.

First, it was AI will never replace human content. Never!

Then, Google will always prioritise human-written material.

Then suddenly, AI content is being indexed and rewarded. And GEO becomes the new SEO.

And now, once again, the pendulum swings back: authentic, human-led content is reasserting itself as the differentiator.

When you have digital entrepreneurs, such as Steven Bartlett calling out AI content, you know you have to protect the human-side of your brand.

For operators trying to build brand visibility and trust, this has been dizzying. But the lesson heading into 2026 is surprisingly clear:

The question isn’t whether AI can generate content, we know it can. It’s whether that content earns belief and signals trust.

And belief and trust, still both stubbornly belong to humans.

Neely Khan, Founder The Third and Chief Storyteller at AWC explains need for balance: “50% of consumers are already using AI to help them search and decide, so GEO matters now, not later. But being surfaced by technology isn’t the same as being chosen by a human. People still fall for brands through story, specificity, and care; and this is something we must continue to hold on to. As the world fills up with answers, difference becomes indispensable. The brands who’ll now lead are those who know how to work with AI, while staying deeply personal and offering something that’s actually worth choosing.”

And Marcus Rader, CEO of Hostaway, notes: “Guests will soon be able to book entire trips through AI alone. But right now, AI often struggles to surface the right properties. That means operators must optimise not just for guests, but for LLMs; making uniqueness, clarity and structured information essential. In the background, AI is rapidly transforming operations, automating daily tasks and freeing managers to grow their business.”

The AI divide of 2026

This is no longer a debate about adoption. AI is already embedded. The divide now is philosophical.

Do you use AI to amplify human judgement? Or to replace it?

One creates standout hospitality. The other? Flawless sameness.

Your guests will always feel the difference.

Hospitality Reimagined: Categories Blur Beyond Recognition

Like it or not, guests stopped caring about labels before the industry did:

Hotel, hometel, vacation rentals, serviced apartment, coliving. These were neat boxes we built to define a sector. But if you think about it, travellers quietly stepped out of them years ago.

What they want now is disarmingly simple: comfort, design, space, reliability, connection, and ease.

If a stay delivers those things, the ‘type’ of accommodation is irrelevant.

A great room is a great room. A soulful apartment is a soulful apartment. A villa you can actually live in for a week feels the same magic regardless of whether it’s listed under “vacation rental” or “resort-style living”

Steve Schwab observes: “The line between hotels and vacation rentals keeps fading. Hotels are becoming more residential and flexible; STRs more consistent and service-oriented. Guests simply see one spectrum of stay types and choose what fits the moment. Brands that can move across formats while keeping a coherent experience will win.”

As an industry, we’re still arguing about definitions, but guests have moved on. For them the name matters less than the experience.

Many years ago, Alan Egan said: “You don’t book a bed, you book an experience.” That same adage is still relevant today.

Hybrid portfolios are emerging as the winning model

The most resilient hospitality brands of 2026 are no longer defined by a single product type. They operate across urban aparthotels, extended-stay formats, flexible living, destination homes and traditional short-stay rentals; often within the same group.

Michele Fitzpatrick, EVP at eviivo, adds: “Experience is the new luxury. Guests are choosing stays with character, story and emotional connection, whether that’s a boutique inn or a design-led rental. The brands that scale without diluting their identity, and that deliver seamless stays across formats and lengths, will lead the next wave of hybrid hospitality.”

This isn’t diversification for its own sake, it’s strategic insulation.

Different models carry different regulatory exposures, different operational rhythms and different revenue cycles. Blending them spreads risk, stabilises cash flow and allows brands to serve the same guest through multiple life and travel moments.

But beneath all the complexity, something simpler is happening.

The industry isn’t really building hybrid portfolios, it’s building hospitality brands that can flex across formats without losing their identity or their promise to the guest.

The product matters less than the experience.

Whether that experience unfolds in a room, a studio, a hometel or a villa is becoming a detail, not a definition.

The successful operators of 2026 are the ones designing for how people want to live, work and travel, not for legacy categories that no longer fit the way guests move through the world.

The borders will keep dissolving. The labels will keep shifting. But the operators who anchor their brand in hospitality, not housing type, will define the next decade.

Traveller Behaviour: Field notes from your future guests

Guest behaviour in 2026 isn’t being shaped by trends. It’s being shaped by lived experiences: cost, flexibility, fatigue and a deeper understanding of what actually matters when people travel.

These are the patterns showing up consistently across global data and on-the-ground operations.

Trip stacking is fully back: The annual ‘one big holiday a year’ is being replaced by a buffet of mini breaks – shorter, more frequent stays shaped by value, spontaneity and calendar gaps.

Sally Henry from Key Data adds further granularity to this shift. “Almost 1 in 4 bookings made for Europe in 2025 were confirmed within 7 days of arrival, and the average booking window has now compressed to 70 days; 10 days shorter than last year. Length of stay is falling too, with European trips averaging 4.9 days and the US at 4.5. Forecasting becomes tougher under these conditions, but dynamic late-booking strategies become far more powerful.

Design fatigue has arrived: The age of all-neutral, endlessly “Instagrammable” minimalism is losing its grip. Guests are craving warmer and more human. They don’t just want to admire a space anymore, they want to feel something inside it.

Hyper-personalisation is expected: Personalisation has crossed the line from “nice extra” to baseline hospitality and guests now expect options, not assumptions, from pre-arrival choices and flexible check-in, to fridge stocking and sleep preferences. The message is simple: Don’t guess who your guest is, let them tell you and deliver.

Many moons ago, when Damian Sheridan first allowed me on stage at a Book Direct Show, I highlighted the mission statement from a Scottish operator.

“We provide luxury surroundings ideal for families and short term visitors – on business and leisure, who simply want something more relaxed and akin to the atmosphere they have at home. Our secret is simply that we look after our guests, very well. Whatever they ask for – if we can, we will!”

“If we can, we will.” Such a powerful statement. That was hyper-personalisation then and today? It’s the baseline guest expectation.

The new definition of wellness: Rewind to the beginning of 2025, there was a LOT of chat about wellness being the traveller trend of the year (another regurgitation), but today’s perception of wellness has moved out of the spa and into the actual ‘slow-stay property’.

Think less candles, more comfort. Spaces designed to help guests exhale: simple luxury, connection to nature, low-clutter environments.

Slow-Stay Properties: Spaces designed to help guests exhale:

- Great mattresses and a choice of pillows

- Blackout blinds

- Low noise pollution

- Low clutter environments

- Clean air

- Lots of daylight (when the blackout blinds are up!)

- Ergonomic spaces

These comfort-first stays now dominate reviews and will continue to do so in 2026.

Utility-first travel is growing under the radar:

- Medical stays

- Family caregiving

- Relocation

- Insurance displacement

- Long-tail work travel

This segment is stable, resilient and quietly profitable; yet still underserved by operators who only design for leisure. It’s not glamorous. It’s dependable and in 2026, that matters.

Event-driven travel reshapes 2026 demand. Early signals from AirDNA’s World Cup Tracker show that major global events are pushing travellers beyond traditional hotel zones and deeper into short-term rentals. Host cities are already seeing sharp demand lifts, but the real trend is the spillover into neighbouring regions as availability tightens and pricing surges.

Chloé Garlaschi from AirDNA notes that demand surged +33% across the tournament footprint during the weekend of the World Cup draw, with some of the strongest spikes seen yet. In Miami, more than 820 bookings were made within 24 hours of Brazil vs. Scotland being confirmed. Boston saw a similar surge for Haiti vs. Scotland. “When a match is announced, fans immediately shift their search patterns,” said Chloe. “Demand doesn’t stay near the stadium, it ripples outward into surrounding areas and neighbouring cities well before prices peak.”

The same pattern is emerging across Northern Italy ahead of the Milan Winter Olympics.

Bookings in Milan are already up 319% year-over-year, with more than 73,000 nights reserved and projected host revenue exceeding €12.1 million: a 589% lift. Surrounding regions are experiencing similar surges, from Verona (+211% revenue) to Antholz-Anterselva (+187% demand).

Big events aren’t a one-off spike. And the takeaway for 2026 isn’t “big events = high demand. We already know this, think: Taylor Swift and Oasis analogies.

It’s that guest behaviour under pressure reveals how they behave in a tightening global market, and that operators shouldn’t blindly follow hotel pricing spirals that push travellers away instead of drawing them in.

In 2026, events are becoming a demand redistribution engine; reshaping where travellers stay and which operator types will benefit.

The Two-Sided Realities of 2026

Beneath the forces shaping 2026 sit the challenges operators rarely plan for. Each carries a risk on one side and an opportunity on the other, and 2026 will belong to those who recognise and react to both.

Fraud gets more sophisticated / Trust becomes a major market advantage

The challenge: Fraud isn’t new in short-term rentals, but AI has transformed how convincing – and how scalable – it has become. Ultra-realistic synthetic IDs, AI-generated property images and “synthetic hosts” make fake listings far harder to spot. The familiar red flags are disappearing, raising the stakes for verification and guest confidence.

The opportunity: Clear positioning and strong trust signals stand out in a noisier market. Operators with a defined niche and visible authenticity become easier to identify and far harder to impersonate.

Urban margins tighten / Growth shifts to lighter-regulated regions

The challenge: Supply caps, licence cancellations and rising compliance costs are squeezing urban portfolios. Competition moves upward, not outward, tightening margins and increasing owner pressure.

The opportunity: Secondary cities, commuter belts and rural destinations are absorbing displaced demand. Growth is shifting sideways, opening doors for operators willing to explore markets beyond the obvious.

And the operators who benefit most will be the ones who treat pricing as a discipline, not an afterthought. “2026 won’t be a volume story,” says Key Data’s Quinn Monescalchi. “Demand is steady, but stays are shorter and booking windows are compressing. Rate strategy becomes the real performance lever. Forward ADR is pacing ahead every month, and RevPAR is lifting in April and May, but only for operators with disciplined, data-led pricing.”

3. Owner expectations rise / Radical transparency builds retention

The challenge: Owners want more reporting, more availability and stronger returns, often without increasing their fee tolerance. The value of professional management can no longer be assumed.

The opportunity: Operators who explain their decisions clearly: pricing, channel mix, performance indicators, market shifts, will strengthen trust and loyalty. Transparency becomes a retention tool, not a burden.

4. Tech consolidation raises dependency / Predictive operations restore stability

The challenge: As PMSs, OTAs and operational platforms expand their reach, operators become structurally dependent on fewer, larger systems. A single update, a visibility change, a pricing tweak, a feature shift, can alter performance overnight.

The opportunity: Predictive tools and controlled internal workflows reduce volatility. Operators who build systems intentionally, not reactively, gain stability and independence in a year defined by platform unpredictability.

5. Automation accelerates / Human warmth becomes a differentiator

The challenge: AI removes friction but can also remove feeling. Over-automated guest journeys risk becoming indistinguishable, and in the pursuit of efficiency, warmth is often the first thing to disappear.

The opportunity: Partnership-led experience networks: chefs, makers, wellness practitioners, local hosts, all reintroduce connection and character. In 2026, the most memorable stays won’t be the most automated; they’ll be the most human.

6. Marketing becomes homogenous / Direct discovery evolves

The challenge: Template-led content and AI-generated messaging have created a crowded field of look-alike brands. Many operators now sound the same, even when their businesses couldn’t be more different.

The opportunity: Direct booking grows through conversational GEO intent i.e. guests searching by need, scenario or feeling rather than destination. AI can lighten the workload, but intent guides visibility. Operators who mirror how guests genuinely think and choose gain a direct advantage.

Rebecca Ward, CEO of Simply Owners, calls 2026 “the year of reconnection.” Guests want direct communication, real answers and human hospitality rather than chatbot loops. “Direct booking isn’t just about margins,” she says, “it’s about relationships that turn a one-time visitor into a lifelong guest.”

The Operator of 2026 and Beyond

Short-term rentals have outgrown their old definitions. The sector isn’t a scrappy tourism outlier anymore; it is becoming a regulated, data-aware, technology-enabled layer of global hospitality.

The operators thriving in this new landscape aren’t the ones shouting the loudest or scaling the fastest. They’re the ones reading the signals early, adapting with intention, and keeping their identity intact as the industry shifts around them.

2026 won’t reward complacency. Operators who stay curious, adjust before they’re forced to and understand both sides of the equation – the risks reshaping the market and the opportunities sitting quietly inside them, will reap the rewards.

Technology will accelerate, regulations will tighten, categories will blur and guest expectations will keep rising. But none of that removes the fundamental truth at the centre of this industry.

Hospitality still belongs to the people who practice it.

Everything else? AI, segmentation, GEO, hybrid models, predictive operations, it’s all just infrastructure.

The real differentiator in 2026 is the operator who knows exactly what they stand for, who they serve and how they show up in a world that won’t stop changing.

And if this year has proven anything, it’s that those operators already exist.

They’re not waiting for the industry to define the future. They’re already building it.

And as always, SCALE will be where these conversations take shape. See you somewhere in the world next year.