The Condo-Hotel Revolution – A Golden Opportunity for Savvy Investors

Posted on - December 5th 2025

Madrid’s Valdebebas, a district buzzing with growth and anticipation, is set to unveil the Hotel 101 next year. But before its first guest checks in, nearly all of its 680 rooms have already been snapped up by eager investors. This extraordinary demand heralds the arrival of the condo-hotel model in Spain – a sophisticated, low-hassle pathway into the lucrative hospitality sector, redefining real estate investment and offering a compelling evolution of the short-term rental market.

The Condo-Hotel Advantage: Passive Income, Tangible Assets

At its core, the condo-hotel offers private investors a unique chance to become stakeholders in a thriving hotel business without the operational burdens. Imagine owning a piece of a bustling hotel, knowing that every detail, from guest services to daily maintenance, is expertly handled, while you simply reap the financial rewards.

For around €200,000 per unit, investors acquire full ownership of a hotel room. While personal usage is typically limited (e.g., five days a year), the true appeal lies in the passive income generation. Unlike traditional landlords, condo-hotel owners aren’t burdened by tenant issues or property upkeep. The hotel management, in this case, Hotel101 Global, takes full responsibility for everything, including guest acquisition, check-in, maintenance, and marketing.

A key differentiator is the pooled revenue model. Instead of relying on the individual occupancy of your specific room, investors receive a share of the total gross room revenue generated by the entire hotel. This ingenious mechanism stabilizes income, making it far more predictable than managing a single rental unit and significantly de-risking the investment. With projected returns exceeding 7% on invested capital, this model presents an attractive alternative to other passive investment vehicles.

Beyond the steady income, investors also gain a tangible asset – a titled and register-able property unit. This offers the dual benefit of a revenue stream combined with potential long-term capital appreciation in a prime location like Valdebebas, especially with the added allure of the forthcoming Formula 1 circuit.

The hotel’s design further underscores this opportunity. With standardized 21 square-meter “Happy Rooms” (each featuring a double bed, single bed, and kitchenette), Hotel 101 leverages economies of scale. From furnishing to maintenance, costs are drastically reduced. As Alvise da Mosto of BARNES España puts it, the “puzzle-like” construction allows for easy, cost-effective panel replacements, ensuring efficiency and profitability. This focus on operational excellence, backed by the global brand strength of Double Dragon Corporation/Hotel101 Global, ensures a consistent flow of both business and leisure guests.

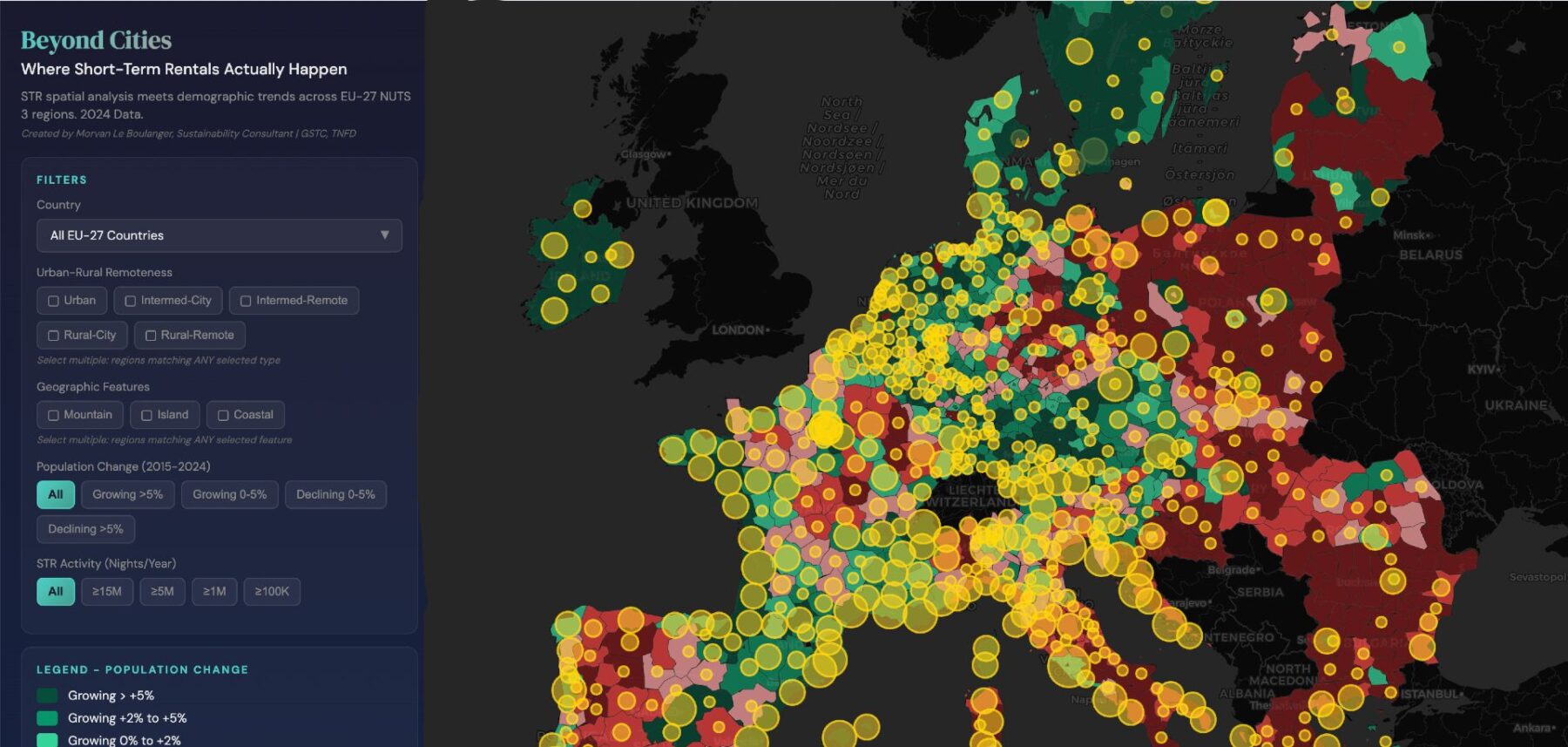

Redefining Short-Term Rentals: Stability in a Shifting Market

The condo-hotel model isn’t just a new investment type; it’s a sophisticated response to the evolving landscape of short-term rentals (STRs). In many ways, it presents a more robust and future-proof alternative for investors previously drawn to platforms like Airbnb.

For investors navigating increasingly complex STR regulations, the condo-hotel offers unparalleled regulatory certainty. Being legally defined as a hotel, these units are immune to the growing restrictions impacting residential STRs in major cities. This model also completely eliminates the management hassle that plagues many STR owners, allowing for a truly “set it and forget it” approach. The pooled income system provides a level of predictability that traditional STRs, often subject to severe seasonal fluctuations, simply cannot match.

A New Chapter for Investment in Madrid

While some voices, like Dr. Jaime Palomera, highlight the model as a symptom of widening social inequality—concentrating wealth among a small percentage of asset-rich individuals—the opportunity for investors is clear. The profile of a Hotel 101 investor is typically one who previously bought multiple apartments for rental, now choosing to invest in 10-15 hotel rooms, seeking higher returns and less management.

From its strategic location near the airport, IFEMA, Real Madrid’s Sports City, and the future Formula 1 circuit, to its ingenious operational model, Hotel 101 represents a bold new chapter for investment in Madrid’s dynamic real estate landscape. It’s not just about owning property; it’s about owning a piece of a globally managed, high-yield hospitality engine, offering a golden opportunity for those looking to diversify their portfolio with a truly passive income stream.